Sunny Outlook for Japan’s Solar Sector

Once the global leader in both photovoltaic (PV) panel manufacturing and power generation, Japanese makers have been undercut by lower-cost competition, while the country has slipped somewhat in terms of installation in recent years. However, it remains at the cutting edge of solar tech and is still the third largest generator of solar power. Now, a new tariff system, solar mandates and geopolitical friction, combined with the drive towards decarbonisation, should provide fresh impetus for growth in the sector.

In 2004, Japan boasted a world-beating 1.13GW of domestic PV generation capacity, while its firms accounted for around half of panel sales worldwide. A decade later, the combined global share of Japanese makers was hovering around the 1% mark, with most of that coming from the domestic market. As in other electronics sectors, the rise of Chinese and South Korean counterparts has put the squeeze on Japan’s manufacturers.

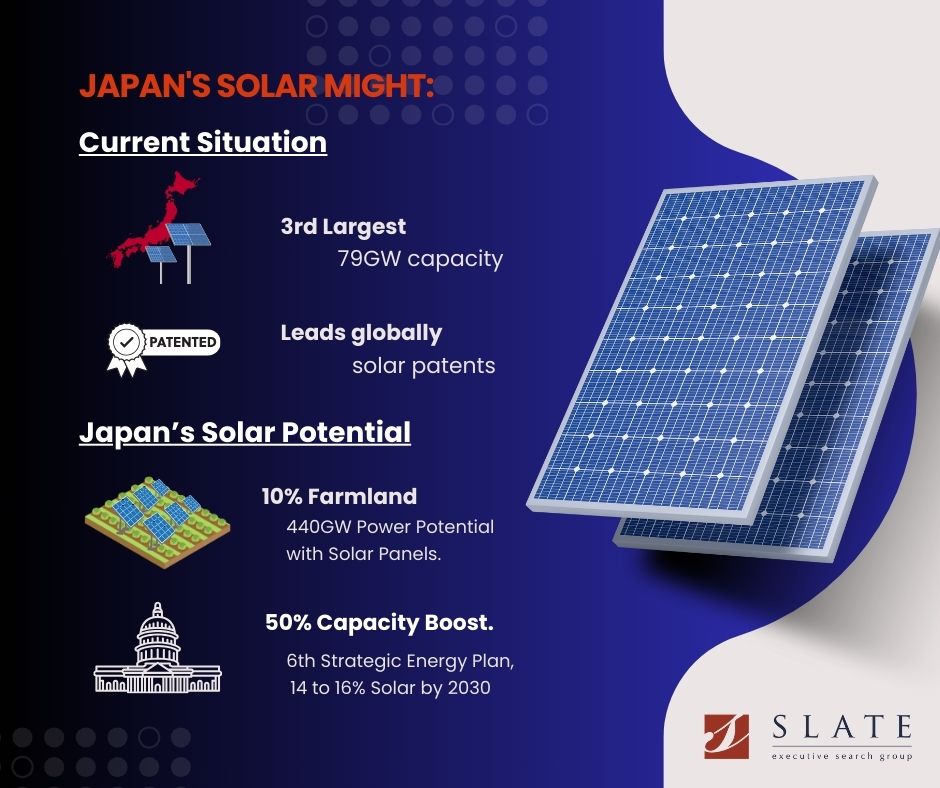

Japan is currently the 3rd largest market worldwide and its target of 53GW of solar PV capacity by 2030 set by the Japanese government in 2009 was surpassed in 2018, and as of last year there was nearly 79GW online domestically.

We need more power

The potential for solar in Japan is exponentially higher. In fact, the country could produce far more than its entire electricity demand through PV, as it could with offshore wind. According to a report in the journal Energy Conversion and Management last year titled ‘100% renewable energy in Japan’, using a combination of PV panels deployed on rooftops, floating solar farms and agricultural land, the country could generate four times as much energy as it needs. Increased solar generation would be a major step towards the government-declared goal of becoming net zero by 2050.

Agrivoltaics, also known as agrophotovoltaics or agrisolar, is the use of the same sunlight for power generation and growing crops, usually in the form of panels positioned over agricultural land. Such plants are already in operation in Japan, and if 10% of agricultural land was equipped with panels, it would provide up to 440GW. In addition, farmland freed up due to the declining population and ageing rural workforce could be converted into solar farms, though the government is keen to raise Japan’s food self-sufficiency and may be reluctant to see too much agricultural land lost.

Development of solar, including agrivoltaics and rooftop, is heavily dependent on feed-in tariffs (FIT), the prices paid to generators for electricity supplied to grids. Solar power was boosted by a generous FIT program that guaranteed purchase by utilities of all generated power. The price paid has been reduced over the years as the cost of solar tech has fallen, but this has contributed to a drop in installation of new capacity. A new Feed-in Premium (FIP) introduced in April 2022 is designed to address this and pays larger generators higher prices at peak times to encourage efficiency in the system.

Up on the roof

Another new scheme due to begin next year will establish a feed-in category for rooftop solar paying 20 to 30% higher prices to reflect the extra installation costs that come with deploying panels on the tops of structures. According to the Center for Low Carbon Society Strategy, a government think-tank, the roofs and grounds of factories, warehouses, industrial parks and other commercial facilities provide around 7,600 square kilometres of space for panel installation.

Rooftop solar will receive another boost beginning in April 2025, when most new buildings in Tokyo, including houses, will have to be equipped with PV panels. Kawasaki City, directly to the south of the capital, followed suit and will bring a similar mandate into effect at the same time.

The final frontiers

Although Japanese panel manufacturers have fierce competition by rivals – even in their home market — the country is still at the forefront technologically. Mitsubishi and Panasonic are the top two firms globally in terms of solar patents, ahead of Samsung with more than 7,000 registered each, while Sharp, Canon and Fujifilm also make the top ten with another 13,000 between them.

Other innovative firms include plastics maker Sekisui Chemical, which is investing 10 billion yen ($67 million) to mass produce durable, lightweight and flexible perovskite solar cells that will help close the gap with Chinese competitors. The government is backing the tech with a plan to install panels utilising perovskite cells in public facilities. Ongoing US-China tensions could also create opportunities for Japanese firms to win back lost international market share.

Japan is also at the forefront of efforts to beam solar power generated in space back to earth using microwaves. Space-based solar power (SBSP) panels would have the advantage of operating around the clock, irrespective of the weather, and thus generating five to 10 times as much power as those on terra firma. A public-private Japanese SBSP venture is aiming to launch a pilot project around 2025.

The government’s sixth Strategic Energy Plan, announced in 2021, calls for solar to account for 14 to 16% of Japan’s energy mix by 2030, necessitating an expansion of approximately 50% from current capacity. This will require a slew of new solar developments and specialist personnel such as project managers to bring them online.

By: Gavin Blair

To find out more about hot roles in sustainability area and elsewhere please contact us at +81-3-5962-5888 or email us at info@slate.co.jp

Current openings:

• Technical Project Managers

• Technical Project Engineers

• Project Developers

• Commercial Managers