Salaries in Japan – Finally Headed Upwards?

Wages and prices in Japan have for decades struggled to break out of a low-growth loop. Pay has barely increased, and on some measures even declined slightly. As long as prices weren’t rising, that wasn’t so much of an issue for local workers, though it did make the country look less attractive from overseas. However, the direction of the spiral appears to have finally switched.

Global economic forces have achieved what the Bank of Japan (BoJ) and successive governments failed to: inflation has come to Japan. The domestic corporate world needs, and is now pushing for, further pay hikes, which is also a requisite for attracting the international talent more vital than ever to the economy. After numerous false dawns, this combination of factors may now push salaries up closer to levels that are competitive in the global market.

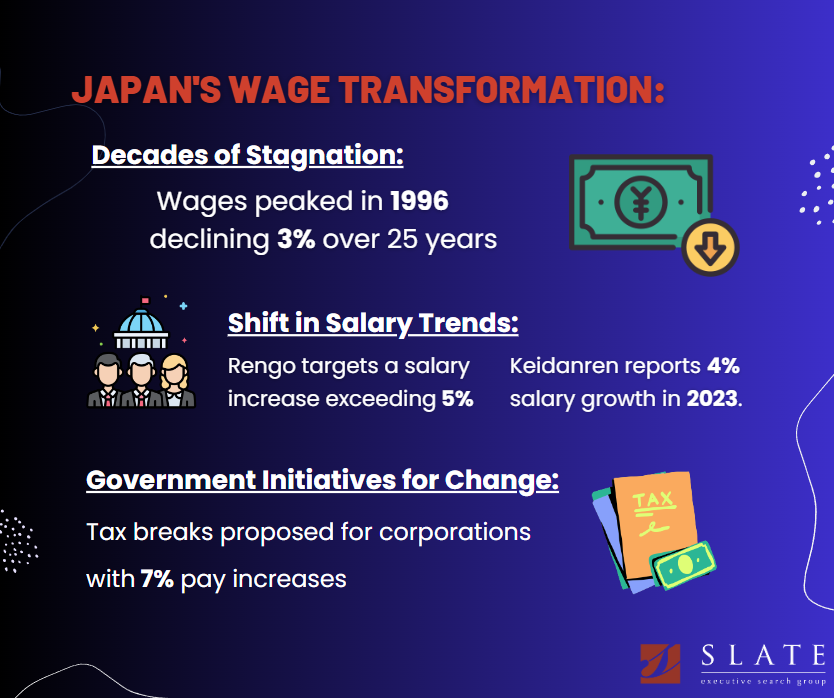

Stagnation in compensation levels was a core element of the headwinds that blew through the aftermath of Japan’s bubble economy bursting in the early 1990s. Indeed, average real (price-adjusted) wages and benefits per worker peaked at 4.27 million yen in 1996, and a quarter century later were down 3 percent to 4.14 million yen, writes Richard Katz in a December article titled ‘How Low Wages Made Japan A Deficit Addict’ on his Japan Economy Watch Substack.

Flipping the script

But signs of a shift are evident. The Japanese Trade Union Confederation, commonly known as Rengo and the largest labour group in the country, has announced it is looking for a rise in salaries for its members to “exceed 5%” in the ‘shunto’ spring negotiations next year. However, it is not only unions calling for higher remuneration, even business associations have now joined the chorus.

Keidanren, Japan’s biggest business lobby, says salary growth at its member corporations averaged nearly 4 percent in 2023, the highest in 31 years. In November it announced it was looking for bigger pay hikes in 2024, which it described as, “an extremely important year to attain sustainable wage growth.”

Inflation began to ease toward the end of 2023, but remains above the BoJ’s target of 2 percent, and consumers have begun to adjust to the new reality of price hikes. Though before a steady cycle of steadily climbing wages and prices is firmly established, challenges remain.

Old capitalism, new capitalism

Prime Minister Fumio Kishida’s flagship policy of ‘new capitalism’ had as one of its central pillars a more equal distribution of wealth. However, he quickly backtracked on the redistribution idea when it spooked stock markets, leaving his platform looking remarkably much like the old capitalism. Talk of redistribution has been replaced by aiming for a virtuous circle of economic growth and wage increases. In reality, the upward pressure on pay has had less to do with government policies and more to do with the economic situation; but increases are increases, and welcome whatever the cause. In addition, workers in better paid jobs have seen proportionally higher wage hikes. Bigger increases for the lower paid would both reduce inequality and boost consumer spending power.

Meanwhile, companies in Japan face a stark choice, particularly those competing for global talent: raise wages or lose workers to rivals. A handful of major Japanese firms have already announced hikes well above inflation.

There and back again

On the other hand, some young Japanese workers have already given up on waiting for higher pay at home and are looking abroad for more lucrative employment opportunities. The weak yen significantly adds to the attraction, with any monies they save and send back to Japan currently worth even more in their homeland.

Although overall numbers remain small compared to how many go abroad to seek greener pastures from other countries, applications for working-holiday visas to Australia and online searches for jobs in other countries surged in Japan this year as the yen hit historic lows. If and when these workers do return home, they will likely bring with them expectations of higher pay and regular raises to the domestic labour market.

And the government has not given up on cajoling firms to raise salaries. In December, the ruling Liberal Democratic Party proposed offering tax breaks to corporations which lift pay by at least 7 percent. For firms that implement hikes of that level, as well as promote child-rearing measures and greater female participation in the workplace, total tax breaks could reach a hefty 35 percent under the new scheme.

After decades of stagnation, there remains work to be done for employees in Japan to catch up with their counterparts in other advanced economies. But there are now at last firm signs that the momentum is headed down the right track.

By: Gavin Blair

We are currently searching for:

•HR Business Partner

•HR Specialist

•Head of R&D

•Fullstack Engineer

•Technology Architect

•Offshore Electrical Engineer

•Project Engineer

•SAP Consultant

•Infrastructure Architect

•Solutions Architect

To find out more about hot roles please contact us at +81-3-5962-5888 or email us at info@slate.co.jp