Global Energy Turmoil Could Boost Japan’s Offshore Wind Sector

On the evening of March 21, the Japanese government issued the first energy supply warning in the nation’s history, urging people, businesses and organisations to save electricity in order to avoid blackouts. The warning came after Japan’s power grid, already under pressure due to the global energy crisis, had been further disrupted by a powerful earthquake five days earlier.

The lights stayed on in the end, but it only took unseasonably cold weather and for a handful of thermal plants to be taken temporarily offline by an earthquake to strain the grid almost beyond capacity. That close call combined with unstable global geopolitics are impacting Japanese energy policy, with a significant acceleration of the shift to renewables one potential result.

Russia is a major supplier of oil, coal and gas to the international market, and the restrictions on that supply caused by its invasion of Ukraine has caused turmoil in energy, spiking prices and spreading uncertainty. In addition, the conflict has further stressed global supply chains already suffering from bottlenecks as economies emerged from the pandemic.

No quick fixes

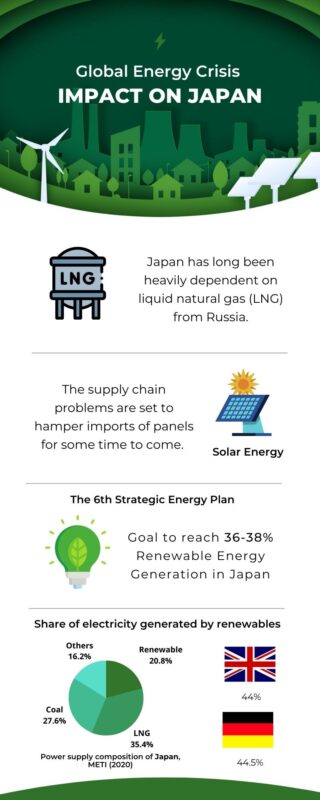

Japan has long been heavily dependent on liquid natural gas (LNG) from Russia, especially since the Fukushima meltdowns took nuclear power generation almost out of the equation. Though imports of Russian oil and coal have been banned in principle, alongside a slew of other trade and financial sanctions, Japan is not halting supplies of LNG from the Sakhalin projects, in which it has major stakes. There is no alternative supply of LNG or other energy source that Japan can practically switch to in the short-term.

“Until the Russia-Ukraine situation, energy was being looked at more from the perspective of long-term decarbonisation, but now it’s a more immediate security of supply issue,” says Dan Shulman, head of Japan energy consulting firm Shulman Advisory.

Even maintaining Russian LNG supplies won’t insulate Japan from energy price hikes or the risk of blackouts “during peak summer and winter season over the next couple of years,” believes Shulman.

In the mix

Over the longer term, the present quagmire should provide more impetus to the shift to renewables.

The 6th Strategic Energy Plan, released by the government last year, called for a doubling of renewable energy generation in Japan to 36-38% of the total by 2030, on the way to carbon neutrality by 2050.While the plan calls for the expansion of solar power, generous subsidies for the sector are mostly a thing of the past and many of the prime sites for large-scale deployment of panels have already been used. In addition, the once world-leading Japanese solar panel manufacturing industry is a pale shadow of its former self, and supply chain problems are set to hamper imports of panels for some time to come.

Blowing in the wind

Geothermal, biomass and hydropower are also predicted to expand, but it is offshore wind that is carrying the highest expectations and the sector with the most obvious potential.

Within weeks of Russia’s invasion of Ukraine, the Ministry of Economy, Trade and Industry (METI) was making noises about the crisis accelerating the development of offshore, notes Shulman.

In the first round of auctions for three offshore developments announced in December last year, consortiums led by Mitsubishi swept the board with surprisingly low bids, causing some disillusionment amongst foreign players in the market. Despite the disappointment, Shulman doesn’t see an exodus from the sector happening.

“Was it a slap in the face? Yes. But is anyone pulling up stakes and going home? I don’t think so,” he suggests. “And I think that’s in part because of what a heavy-duty business offshore wind development is in the first place, and the kind of financial resources these companies need to have to be in this game at all.”

An offshore wind executive predicts that Mitsubishi, “will probably be in the red on all three projects from day one,” and is concerned that the low bid levels “sets a benchmark price for future projects.”

Future hopes

However, METI appears to have taken on board some of the criticism of the auction results and is understood to be revising its evaluation criteria for the next auction round, the announcement of which has been pushed back to year-end.

Japan has doubled its share of electricity generated by renewables to around 20% over the last decade. Germany has more than doubled its share, but from a higher starting point to 44.5%. The UK began at the same share, but has grown its renewables share to 44% over the same period. So, Japan clearly has room to catch up in the renewables stakes, the increased motivation to do so in light of pressing energy security concerns, and a vast coastline along which to expand its offshore wind capacity.

By: Gavin Blair

We are currently hiring for:

Technical Project Manager

Service Manager/ Engineers

Project Developer

Commercial Manager

Regulatory Affairs Manager

Electrical Engineers

EHS Manager