Drug Price Revisions to Shake Up the Pharma Sector

Revisions to prices for drugs reimbursed under Japan’s National Health Insurance (NHI) system that came into effect on April 1 are more drastic than those in recent years, causing concern and uncertainty in the industry.

A number of companies will lose out due to large cuts in the prices of some of their leading pharmaceutical products, while there are a few ‘winners’ that will see small price increases for some drugs. But there are also wider worries around the unpredictability of ongoing pricing policy and the implications of that for drug development and distribution in Japan.

Complex criteria and opaqueness

Against a background of ever more sophisticated, and often more expensive, medical solutions, and an expanding elderly population, the Japanese government has been actively trying to reduce public spending on drugs.

A key element of this has been the review of prescription drug prices every two years by the Central Social Insurance Medical Council, overseen by the Ministry of Health, Labour and Welfare (MHLW) and commonly referred to as Chuikyo. In 2021, an ‘in-between year’ revision was carried out, a policy that looks set to be continued.

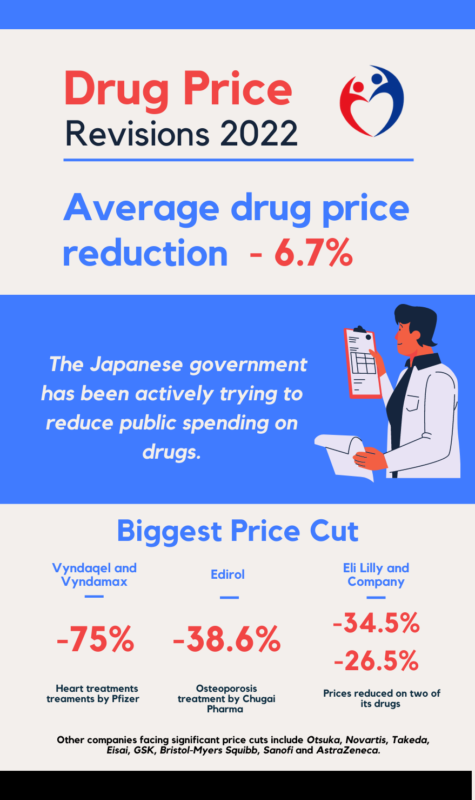

In addition, the cuts to prices announced this year were on a larger scale than those seen in previous rounds. The average reduction was 6.7%, amounting to a fall of around 600 billion yen ($4.66 billion) in total reimbursement payments for drugs, compared to a reduction of 430 billion last year.

Chuikyo’s assessment criteria for pricing and revisions are complex, and the process seen as opaque by some in the industry. As well as taking into account the price for drugs of comparable efficacy, there are several special rules such as ‘market expansion repricing’ which cuts prices on sales above a certain level for drugs with a very large market presence.

On the other hand, there is a Price Maintenance Premium (PMP), which provides some price protection for innovative medicines, usually for the duration of their patent. But the PMP was revised in 2018 and price protection for numerous medicines has been removed, provoking complaints of bias against foreign pharma firms.

The Pharmaceutical Research and Manufacturers of America in its 2022 report criticised the PMP changes and stated, “over the past several years, Japan has implemented over 50 changes to pricing policies that significantly undermine efforts to carry a fair share of the costs of global research and development.”

In response to April’s price revisions, the association said: “The scope of the annual price cut policy goes far beyond any options put forward for discussion at the Chuikyo and was never shared with the industry prior to its formal announcement.”

Biggest Price Cut

The biggest pricing cuts are on Pfizer products, with 75% reductions for its two expensive heart treatments Vyndaqel and Vyndamax. Chugai Pharma’s osteoporosis treatment Edirol will see its price cut by 38.6%, while US firm Eli Lilly will have prices reduced on two of its drugs by 34.5% and 26.2%. Other companies facing significant price cuts include Otsuka, Novartis, Takeda, Eisai, GSK, Bristol-Myers Squibb, Sanofi and AstraZeneca.

Japanese pharma firms have already been involved in acquisition deals this year, including Fujifilm’s purchase of privately-held Shenandoah Biotechnology in the US. Many are still sitting on large cash piles and further deals are a possibility, though there are few major domestic takeover targets or potential merger partners that analysts are pointing at.

However, the latest round of price revisions and the ongoing uncertainty around future cuts could lead to some consolidation in the sector. And if global pharma firms begin to take the view that Japan is becoming an increasingly unattractive market, that could result in a scaling down of local operations, reduced investment or even divestiture.

Signs of hope

But all is not doom and gloom on the domestic front. The MHLW announced a Vision Plan for the Japanese Pharma industry in September 2021, driven in part by concern over the slow development of COVID-19 vaccines by local firms. The plan aims to improve competitiveness, encourage innovation and boost the overseas sales of domestic pharma firms. The importance of future pricing for R&D investment is addressed in the plan, though that has not been reflected in the latest price revisions.

Finding winners

For those weighing up potential employers in the sector, it will not be easy to predict which firms might flourish in this uncertain landscape. But with established drugs and treatments facing the biggest price cuts, pharma firms with promising pipelines, those investing heavily in R&D or the ambition and know-how to make savvy acquisitions may be the smart option in the current environment.

By: Gavin Blair

To find out more about hot roles in healthcare and elsewhere please contact us at +81-3-5962-5888 or email us at info@slate.co.jp