The Dawn of Digital Transformation in Japanese Healthcare

Penetration of digital technology is varying significantly by sector. Along with energy, insurance and the public sector, the global healthcare industry remains something of a laggard in the digitalisation stakes.

Japan is far from a digital transformation (DX) pioneer, and healthcare is certainly no exception. However, the nation’s well-documented demographic issues are piling fiscal pressure on the government, with rising healthcare costs for the aging population a major contributor.

Combined with the enforced adoption of some aspects of DX brought about by the pandemic, the need for greater efficiency should provide the necessary spur to accelerate its adoption in Japanese healthcare.

Across the board

Genuine healthcare DX is about much more than just switching from paper-based medical records, appointment systems and billing, changes that are already underway. Even in Japan, around 80% of medical records are digitalised, according to a survey taken by Nikkei Research in March.

There is also huge potential in areas such as telemedicine, telepharmacy, medical apps and the deployment of connected devices both inside care facilities and for remote use.

DX requires innovation by both private companies and governments, something particularly true for healthcare, where there is considerable public sector involvement in nearly every country.

Governments in countries including the US, the UK, Denmark and Australia have all taken proactive roles in digitising healthcare through policies such as establishing centralised digital databases, app-based platforms and providing grants to enable DX.

At the beginning of the pandemic, the UK’s National Health Service quickly rolled out Microsoft Teams to give all of its 1.2 million employees the ability to communicate with each other whether they were working remotely or not, share medical records and other data, and provide information to patients.

Meanwhile, of healthcare executives in six countries surveyed for a report issued by Accenture at the start of this year, 81% said the pace of DX in their organisations was accelerating. Nevertheless, there is a long way to go for much of the industry.

High hurdles

Counterintuitively, barriers to full-blown digital adoption are often less to do with technological capacity and knowhow, and more about organisational culture and resistance to change. And even if management is on board with innovation, medical professionals and admin staff, and to some extent patients, also need to be willing to embrace the shift for a smooth and comprehensive transformation to take effect.

For example, a government can approve for medical insurance reimbursement an internet-connected device that monitors blood sugar levels in diabetics, and hospitals and clinics can choose to adopt it. But if doctors are not convinced of its effectiveness or are nervous about making mistakes with a new technology it won’t get prescribed. And if patients are concerned about their personal health data falling into the wrong hands it won’t be worn.

Such fears are particularly strong around information related to people’s health, where there are worries about government access to their private data, as well as the dangers of hacking.

Cybersecurity is then an issue, not only for data recorded by connected devices, but for all digitised information. In Japan, many hospitals do not have cybersecurity protocols in place, something that has hampered remote working during the pandemic and has wider implications for healthcare DX.

Data security concerns are a factor in the slow adoption of full digitalisation, even where the process has begun. The Nikkei survey which found the majority of medical records had been digitised also reported that only 10% of them were stored on the cloud, which is often seen as more vulnerable to cyberattacks. Unless cybersecurity is enhanced, full DX cannot be achieved.

Pandemic push

Covid-19 forced the healthcare industry globally into taking greater steps towards DX, particularly in terms of remote working, telemedicine and telepharmacy.

The Japanese government granted temporary permission for online consultations and prescriptions in April 2020, though uptake was low, with less than 15% of medical facilities making use of it. Fewer than 10,000 initial consultations with doctors a month were carried out online at the peak in May, and numbers fell after that.

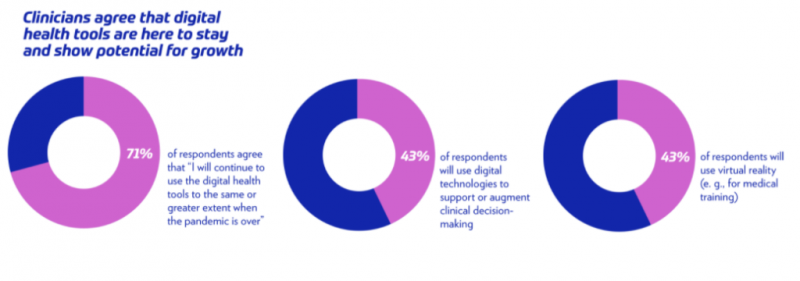

In the US, on the other hand, use of telemedicine has exploded to 38 times the rates seen pre-pandemic, resulting in hundreds of millions of kilometres saved in travel time and expense alone. According to a report by the Healthcare Information and Management Systems Society, 51% of patients in the US are in favour of having only telehealth consultations, and 71% of healthcare providers plan to continue using digital health tools to the same extent or more once the pandemic is over.

In June this year, Japan decided to make the pandemic-driven telemedicine rules on consultations permanent, but it remains to be seen how quickly doctors and patients will choose to adopt it.

There are other more promising signs of progress, some small, others bigger.

In August 2020, the government approved an app to help people stop smoking, known as CureApp, making it eligible for reimbursement under the national health insurance system at the end of last year. Developed by a Tokyo start-up, it was the first digital therapeutic app to be approved in Japan, and reportedly the first such app in the world to be prescribed for quitting smoking.

Then at the start of this year, the Japanese government announced it was partnering with Cisco to facilitate DX, with Japan’s healthcare sector being a specific area of focus, through its Country Digital Acceleration Program. Cisco will work with companies, academia and the public sector to promote the use of AI, the IoT, data analytics and edge computing in healthcare to “accelerate the transition to remote functionality to maintain operational continuity.”

Room for growth

Japan’s total healthcare market is estimated at 43.4 trillion yen ($383 billion), a figure the government predicts will grow to 100 trillion by 2040, making it one of the few domestic industries almost guaranteed to experience significant expansion. And digital technology is set to be a major engine of that growth and to account for an increasingly large share of healthcare expenditure.