Japanese Firms Make More Appetising M&A Targets Than Ever

Following a pandemic-induced lull in 2020, M&A roared back last year and cross-border deals hit all-time record levels. Japanese firms have long been known for their overseas acquisitions, but a combination of shifts in the corporate landscape, succession issues and the current weak yen are making inbound deals more attractive and feasible than ever.

The second half of 2021 saw the value of large deals globally jump by two-thirds to $5.8 trillion. Both private equity (PE) and the growth of special-purpose acquisition companies (SPACs) helped drive the number and value of transactions.

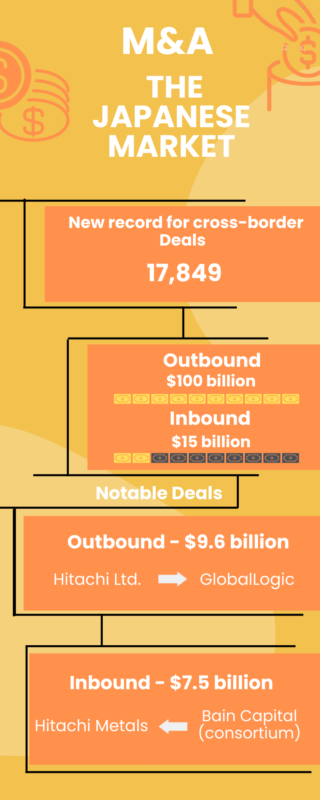

International deals grew even faster as their value reached a record $2.1 trillion in 2021, comfortably topping the previous high of $1.8 trillion set in 2007, according to financial data firm Refinitiv. The number of cross-border acquisitions was also a record, coming in at 17,849.

Two-Way Street

Although the situation is very different to that back in the 1980s, when there was panic in some quarters of the US and Europe that Japan Inc. was embarking on a prolonged, predatory buying spree, the amount of outbound M&A still dwarfs the deal flow in the opposite direction. According to Dealogic data, last year it was $100 billion outbound versus $15 billion inbound.

Hitachi’s dealings show both how the landscape has shifted and what can be achieved with a coherent strategy. The conglomerate’s purchase of US digital solutions firm GlobalLogic for $9.6 billion was the biggest deal by a Japanese firm last year. On the other hand, it also announced the sale of Hitachi Metals to a consortium led by Bain Capital for $7.5 billion. That followed its previous sale of Hitachi Chemicals, divestitures of a type and scale once almost unthinkable for a traditional Japanese corporation.

Bain Capital is among the foreign funds which have submitted proposals to acquire and restructure Toshiba, where the strategy in recent years has been considerably less coherent. The storied but troubled corporation’s nuclear power division means that the Japanese government will almost certainly want to have some degree of control over the new structure, but even the involvement of overseas investment funds is an indicator of change.

Succession Season

While conglomerates are transforming their portfolios and cutting non-core divisions loose, for many family-run small and medium enterprises in Japan, succession is a major issue.

The shrinking younger population inevitably increases the number of businesses where there is no capable or willing candidate among the next generation to take over when the current leadership retires. This can in turn lead to a search for new owners.

Yuuichiro Nakajima, managing director of Crimson Phoenix, a cross-border M&A advisory based in Tokyo and London, notes that PE is particularly active in the space, “with many setting up funds specifically to take advantage of succession issues.”

Younger Japanese companies, often with owner-CEOs in their 30s or 40s who are open to the idea of selling out and doing something else, is also a growing target market for inbound deals, according to Nakajima. This new generation of owners have far fewer qualms about being taken over, including by outsiders, than those who came before them did.

Another factor making Japan more attractive for inbound investment is the fact that China under Xi Jinping has become an increasingly unwelcome environment for foreign capital and is currently a difficult place to do business given the travel restrictions and zero-Covid policy.

Bargain Time

And the icing on the cake for those looking at acquiring a Japanese business is the current weak yen, effectively delivering approximately 20% discounts in dollar terms on all assets, and smaller but still significant savings when purchasing with other major currencies.

Nakajima’s firm recently acted for an Austrian company, currently represents a Canadian firm and is in discussions with a Swiss business, all regarding acquisitions in Japan. Although the weaker yen “certainly does encourage buyers to look at opportunities in Japan,” he believes that it rarely supersedes strategic reasons as the primary motivation for a cross-border deal.

Once transactions are completed, then come the tasks of integration, merger or management, depending on the structure and style of the entities involved. Whichever route is taken, staff who are able to work multilingually and cross-culturally to deliver results in the new environment will be a necessity.

By Gavin Blair