Can Tech Save Japan and the Yen?

An inbound tourism boom and the weak yen have sparked a debate in Japan about two-tier pricing: charging more at restaurants and sightseeing spots to visitors from overseas than locals. There has been inevitable backlash from a section of foreign residents complaining they’ll have to prove they’re not tourists, and talk about the fairness of such pricing schemes. However, the discussion has somewhat overlooked what this says about Japan’s economic prowess: weak currencies, two-tier charges and cheap prices are phenomena usually associated with developing countries.

Given its demographic profile and global structural shifts, fully recapturing its former economic glory is probably unrealistic for Japan. But by fully embracing technologies such as AI and digitalisation, as well as other necessary economic reforms, the nation should be able to raise productivity enough to maintain a comfortable standard of living and quality of life for its citizens.

A yen for change

It now seems clear that the Bank of Japan cannot buy its way to a stronger yen – multi-billion-dollar interventions have only had limited and temporary effects in recent times – currency markets are too large and changes in the underlying fundamentals are essential.

The weak yen has both multiple causes and multiple impacts. In addition to the interest rate differential with the United States and other major countries, lost economic strength and competitiveness has also pushed the currency down against its counterparts. Though a cheap yen does help exporters and firms with significant overseas operations, it raises the prices of raw materials and consumer goods in Japan. It also makes Japanese salaries, already on the low side, look even less attractive from abroad when calculated in dollars or other currencies.

Foreign exchange

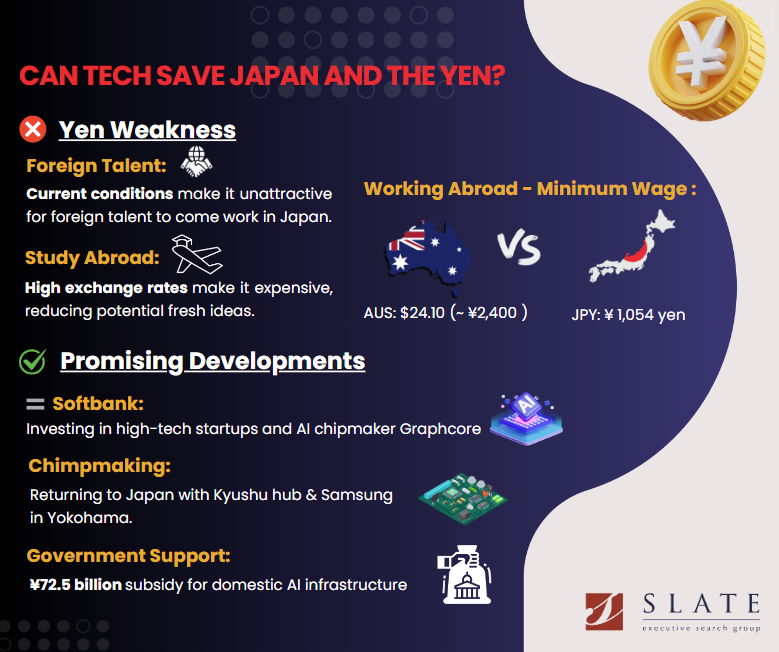

And Japan needs more foreign talent to make up labour shortages and invigorate its corporate world. Exchange rates are also making it much more expensive for Japanese to study abroad, reducing the flow of another potential source of fresh ideas.

On the other hand, the wage situation and weak currency are pushing more young Japanese to work overseas to earn and save money. The attraction is obvious. For example, Australia’s minimum wage is AUS$24.10, around 2,400 yen, comfortably more than double the 1,054 yen that Japan’s is about to be raised to. Nevertheless, the numbers going abroad are still relatively small and most are not working in the kinds of fields where they will bring back the skills needed to breathe new life into Japan Inc.

Can tech save the day?

Re-energising and bolstering the domestic economy will require adoption of emerging technologies at a pace that much of corporate and public sector Japan has struggled to move at in recent decades. While digital transformation (DX) and AI will not solve every problem, they can increase efficiency and help alleviate worker shortages.

The delayed victory of Digital Minister Taro Kono over the use of floppy disks in governmental bureaucracy shines a light on the challenges ahead.

“We have won the war on floppy disks on June 28!” a triumphant Taro told Reuters.

Taro effectively lost a previous battle to eliminate fax usage by ministries and agencies, a conflict he may now return to with renewed confidence.

Green shoots

There are though promising signs. Japan’s SoftBank is one of the biggest global investors in high-tech startups, and it recently announced the purchase of AI chipmaker Graphcore in what is likely to be a multi-billion-dollar deal. Like SoftBank’s previous semiconductor acquisition ARM, Graphcore is headquartered in Britain, another island nation with a distinctive set of economic challenges.

Chipmaking is also returning to Japan, which dominated the global sector in the 1980s. A combination of supply chain risk diversification and so-called ‘friend-shoring’ by Taiwanese and US entities, helped by the cheap yen and government subsidies, is helping to turn Kyushu into a semiconductor hub. Meanwhile, also making use of subsidies, Samsung is establishing a new chip facility in Yokohama.

Much of the demand for chips is being driven by advanced tech such as AI, smart devices and the Internet of Things (IoT), which are also increasing the need for data centres. Japan is also feeling the effects here of a lack of domestic capacity and the yen’s weakness. Overseas cloud providers, such as Amazon, Google and Microsoft, have captured around 70% of the domestic market, and Japanese corporate customers are paying for services in dollars, contributing to a record ‘digital balance of payments’ deficit of 5.5 trillion yen ($36 billion) last year.

Recognising the issue, the government in April announced a 72.5-billion-yen ($470 million) subsidy programme to support domestic infrastructure for AI.

There is much to be done if cutting-edge tech is to be a driver of further economic revitalisation and protector of living standards, and talented people will be needed to make that a reality.

By: Gavin Blair

Current openings:

•Data Activation Manager at Top Global Consulting Firm.

•SQA Manager at Leading Technology Corporation

•Program Manager for Digital Transformation at Leading Technology Services Firm”

•Senior Data Scientist, Japan Consumer Innovation – Top Global E-Commerce Corporation

•Cyber-Security Lead at Leading Global Consulting Firm

•Data Engineer for Data Enrichment at Leading Financial Services Company

To find out more about hot roles please contact us at +81-3-5962-5888 or email us at info@slate.co.jp